Council Tax Enforcement Letter – What to Do Now It’s Serious

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a Council Tax Enforcement Letter? You are not alone. Each month, more than 170,000 people come to our website seeking advice on their debt issues. We understand how serious and stressful this situation can be for you.

In this article, we will explain:

- What a Council Tax Enforcement Letter is.

- What can happen if you don’t pay your council tax.

- Steps you can take to handle this situation.

- How to appeal your council tax bill.

- How to deal with a bailiff.

We have a lot of experience in these matters and want to share what we know with you. We understand your worry, and we’re here to help.

Let’s dive in to discuss your options and the best course of action moving forward.

What Is a Council Tax Enforcement Letter?

How To Deal With a Council Tax Enforcement Letter

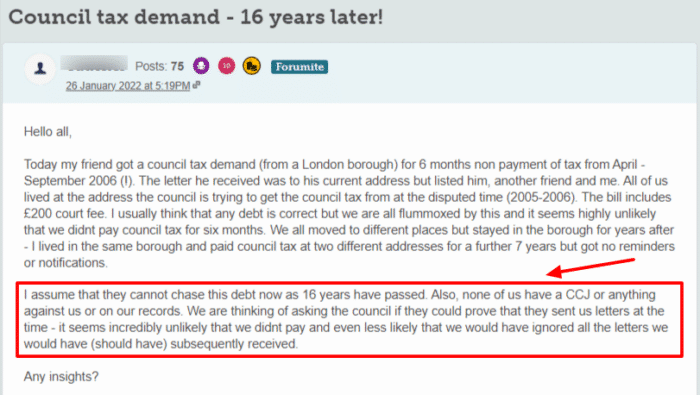

You can check the date of the council tax arrears and see how old the debt is. It isn’t impossible for councils to make a mistake and send out requests for arrears that are statute-barred. Take a look at this example.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to the council and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

When they do arrive at your home, they cannot force entry. This means that they can’t get into your home unless you leave the door open. They are not allowed to force the door or any windows open in order to get in.

So if you don’t want the bailiffs in your home, don’t invite them in.

What if I am a vulnerable person?

Before you start addressing the Notice of Enforcement, you should know that if you:

- Are disabled in any way or extremely ill

- Suffer from any kind of mental illness

- Have children or are pregnant

- Are under the age of 18 or over the age of 65

- Are dealing with a stressful situation such as the death of a loved one or unemployment

- Don’t speak English very well

You are considered a vulnerable person. This means that any bailiffs will have to follow some additional rules to ensure their visit is as easy on you as possible.

Furthermore, if any of these conditions apply to you, you can get more time to deal with the Notice of Enforcement. You can also get more time if the Notice of Enforcement was not sent to you properly by the bailiffs.

If you fall into any of the above categories, you need to either tell the bailiffs yourself or get a relative or carer to do it for you. You can then contact them by phone or by post. I have a free letter template that you can use to explain your situation.

When you speak to the bailiffs, you need to:

- Tell them that you’re vulnerable

- Explain why you would find dealing with bailiffs more difficult than other people in the same situation

- Ask them to stop any visits in the future because it will cause harm and distress to you

- Tell them if a letter or a visit could make your situation worse – this could be the case if you have a mental health problem or a heart condition, for example.

Make a note of what you agree with the bailiffs about future contact. This will make it easier to argue with them if they don’t stick to this new agreement, or if you need to make a complaint.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Make Sure To Check All Relevant Facts

Is It Actually a Real Council Tax Enforcement Letter?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Getting Enforcement Stopped

» TAKE ACTION NOW: Fill out the short debt form

How do I appeal my council tax bill?

If you think that your council tax bill is wrong, you need to write to your council and tell them why you think that your bill is incorrect. You can find out who your local council is here.

Your council will then reply to you within 2 months.

This reply will either:

- Tell you you are correct, your bill is wrong, and a new bill will be sent.

- Tell you that the bill is right and explain why.

If the council replies and says that your bill is wrong, you must carry on paying the amount on your old bill until a new one comes.

If you wish to appeal your council’s decision, or you don’t get a reply within 2 months, you can appeal to the Valuation Tribunal. This is a free services but you need to pay for your own costs.

For your appeal to be valid, you need to:

- 2 months of the council telling you their decision

- 4 months after you first wrote to the council about your council tax bill.

If the Valuation Tribunal agrees with you and says that the council was wrong, your new bill will be sent along with your monthly adjustments.

Can Bailiffs Take Items From Your Home?

Will a Bailiff Charge Me Fees for Council Tax Debt?

Yes, a bailiff will charge fees. This will be added to the total value of your debt.

These fees are generally quite similar, and some bailiff charges are even standardised. County Court bailiffs, for example, have set fees of £75 for a Notice of Enforcement and £235 if they have to actually enforce the debt.

Keep in mind that the enforcement fee can be a bit higher. Usually, they will charge an extra 7.5% of your debt if that debt is over £1,000.

This means that if you have a debt of £1,500 that you don’t pay, you will be charged:

- £75 for Notice of Enforcement

- £235 for Enforcement

- £112.50 for the 7.5% over £1,000.

Total: £422.50.

How do I Complain About a Bailiff?

If you think that your bailiff has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to the bailiff’s company or agency so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, the bailiff’s company may be fined. You could even be owed compensation.

If the bailiff’s company is not registered with the FCA, you can make your secondary complaints to the Civil Enforcement Authority (CIVEA). CIVEA has its own set of guidelines and procedures for dealing with complaints against its members.