P&J Debt Collection – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprising letter from P&J Debt Collection? This could make you feel puzzled, worried, or unsure. But don’t worry; you’re in the right place to find answers. Every month, over 170,000 people visit our website for information about their debt problems.

In this article, we will explain:

- How to check if the debt is really yours.

- If you can ignore P&J Debt Collection.

- Ways to stop P&J Debt Collection from chasing you too much.

- How to set up a payment plan.

- If you can write off some of your debt.

Our team knows how it feels to have debt collectors chasing you. We have been there too. We understand your worries and fears and are here to help.

Here’s how you can deal with P&J Debt Collection.

Have you received a P&J Debt Collection letter?

As mentioned earlier, P&J might send a letter to your home address. This letter will ask you to pay just like any calls you receive. But it may threaten legal action against you if you don’t pay by a deadline they have set.

When a letter states this, it is known as a Letter Before Action. But will you really be taken to court for failing to pay?

First, check if the P&J debt can be enforced

A lot of UK debts can become legally unenforceable after five or six years, depending on location. This would mean the debt cannot be subject to litigation. And without a judge able to tell you to pay, there is never an obligation to pay.

The debt that P&J are chasing you for might have already become too old to be recovered. You should check if this is the case, and if it is, tell P&J you won’t be paying and ask their client to wipe the debt instead.

It’s still enforceable? Here’s your next step

Your debt might be still enforceable, but you still won’t have to pay straight away unless you wish to. Instead, you could ask P&J Debt Collection to prove you owe the debt in a letter.

They must then send you evidence of the debt, such as a copy of the agreement you signed with the private hospital or clinic. Until this is sent, you don’t have to pay. It’s an effective way to reply if you want some breathing space or you want P&J to realise they have the wrong person.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you ignore P&J Debt Collection?

Contrary to stories you might read online, ignoring a debt collection agency is risky. A small number of people might ignore a debt collection company and never have to pay, but you could be taken to court.

Does that mean you have to pay P&J Debt Collection?

Not ignoring them isn’t the same as paying P&J. There are ways to react to P&J communications without having to pay immediately.

You could of course pay the debt if you recognise it as yours and want to get rid of it. This would also stop it from harming your credit score any further.

But what else could you do?

Are P&J Debt Collection also bailiffs?

» TAKE ACTION NOW: Fill out the short debt form

P&J are not bailiffs. They only chase debts at the start of the recovery process, whereas bailiffs are used as a last resort after a court order has been issued. Therefore, they shouldn’t come to your home or make threats of taking your possessions over the phone.

If they do pretend to be bailiffs or have similar legal powers, you should report their behaviour to the Ombudsman Service. They could be fined!

P&J Debt Collection reviews

P&J Debt Collection has limited online reviews. On Trustpilot, they received a negative review from a client referencing the company’s lack of communication and supposed lost records, which are preventing the client from pursuing court action.

P&J Debt Collection then replied to this review by suggesting the client wasn’t willing to pay. It all looks a bit messy and unprofessional from the outside.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will P&J Debt Collection take you to court?

It’s impossible to know whether P&J’s client will pursue court action for the debt. Sometimes they might not, but you won’t be able to tell. P&J may still make legal threats when their client doesn’t want litigation. And that’s because it’s an effective worry tactic that encourages debtors to pay.

If you are taken to court, the claimant could ask the judge to issue a court order which makes you legally responsible to clear the debt. Ignoring a court order can lead to debt enforcement action, which could come in the form of (expensive!) bailiffs.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

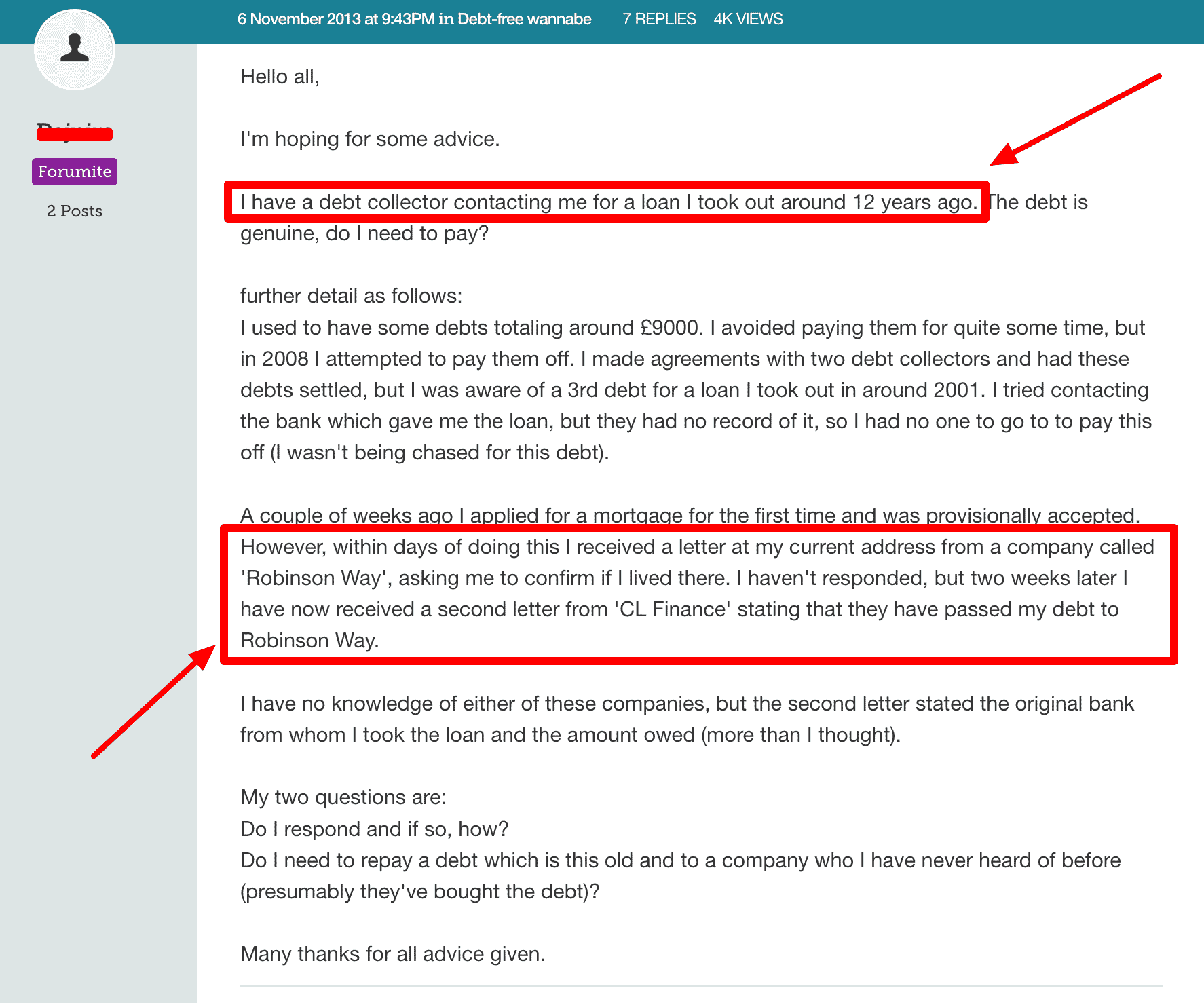

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

P&J Debt Services Contact Details

| Address: | P&J Consumer Debt Services, Maylands Business Centre, Redbourn Road, Hemel Hempstead HP2 7ES |

| Phone: | 01442 848500 |

| Email: | [email protected] |

| Website: | https://www.pjcds.co.uk/ |