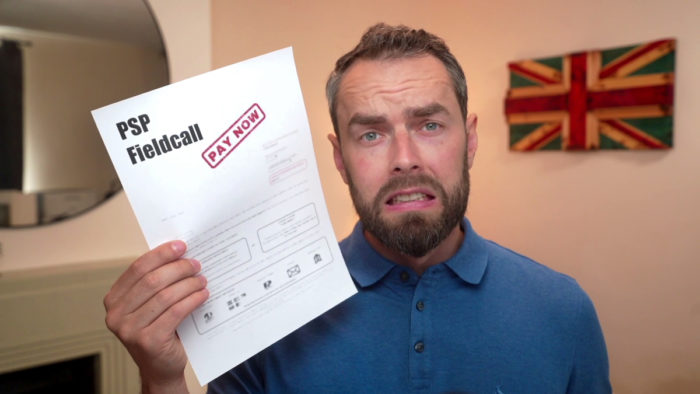

PSP Fieldcall – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received an unexpected letter from PSP Fieldcall? Don’t worry, you’re not alone. Every month, over 170,000 people come to our website seeking advice on debt problems. We’re here to help you understand what PSP Fieldcall is and what you can do about it.

In this easy-to-understand guide, we’ll cover:

- Who PSP Fieldcall is, and who they collect debt for.

- How to check if the debt they say you owe is real.

- Steps to take if you can’t afford to pay.

- How you might be able to write off some PSP Fieldcall debt.

- What to do if PSP Fieldcall can prove the debt.

We know getting a debt letter can be scary. Our team has been there too, so we understand what you’re going through. Read this guide to learn more about your options and find out how you can deal with PSP Fieldcall. Remember, ignoring the problem won’t make it go away, but getting the right information can help you take control.

Let’s dive into dealing with PSP Fieldcall.

Have you received a PSP Fieldcall debt letter?

If PSP Fieldcall is chasing you for money owed to one of their clients, you’ll likely receive a letter. This may come in the mail or as illustrated earlier, someone from PSP Fieldcall might try to hand-deliver the letter.

These letters are called Letters Before Action or an LBA. They are designed to encourage you to pay or face the possibility of legal action. However, there is no certainty whether you will be taken to court for not paying. It will probably depend on their client’s wishes and the amount of money owed.

Should you pay a PSP Fieldcall debt?

You shouldn’t ignore a PSP Fieldcall debt letter, but neither do you have to pay straight away. There are ways to respond to these payment requests and legal threats without paying.

This stops you from ignoring the letter which can result in a potential legal challenge. But it doesn’t mean giving up either.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Check to see if your debt is collectable

The first thing to do when you receive a PSP Fieldcall debt letter is to check if the debt they’re trying to collect is still “collectable”. Many debt matters in the UK cannot be taken to court if the debt is at least six years old and you haven’t made a payment towards the debt in the last six years. This is called a statute barred debt.

When a debt cannot go to court, a judge can never issue you with an order to pay. So from a legal standpoint, you’re never forced to pay. The debt will still exist and could harm your credit file, but PSP Fieldcall should stop asking for payment. You might even get their client to write it off.

Always double-check that your debt has become too old to be collected by speaking with a debt charity. Then send PSP Fieldcall a letter to inform them this is the reason you won’t be paying.

Ask PSP Fieldcall to prove the debt first!

If your debt can still go to court and be legally enforced, you can ask PSP Fieldcall to prove you owe the debt instead. You should do this by sending a prove-it letter. We’ve created a template you can use for free to save you time.

They must respond with concrete proof that you owe the money, which should be a copy of a signed agreement when applicable. If they don’t you don’t need to pay. And if they subsequently take you to court, you should tell the judge that your prove the debt letter was ignored.

» TAKE ACTION NOW: Fill out the short debt form

PSP Fieldcall proved the debt – do I pay?

If PSP Fieldcall proves your debt you should consider paying or agreeing on a payment plan. If not, their client could take legal action.

Other Debt Collectors

You should check for more outstanding debts that you may have with other companies or debt collectors. Here are four steps you could take:

- Check your credit report for other defaults

- Check your email and post for reminders or overdue notices

- Check the court records for CCJs against you

- Check your bank statements for the names of other debt collectors

There are hundreds of debt collectors in the UK and each works with different companies to collect debts.

For example, Cabot Financial have been known to collect for the DVLA while Lowell Financial and PRA Group buy debts from various credit card companies like Barclaycard.

If you see a name on your bank statement that you don’t recognise then you can search MoneyNerd to see if they’re a debt collector.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Are PSP Fieldcall bailiffs?

PSP Fieldcall are not bailiffs. They are just an administration-type business and have no legal powers to enforce debts that have been ordered to be paid by a judge.

If PSP Fieldcall suggests they are bailiffs or tells you they can repossess your items, you should report them to the Financial Ombudsman Service (FOS).

The experience told above suggests that PSP Fieldcall agents will come to your home to hand-deliver letters. This is probably to make you engage with them and put pressure on them to pay. But you don’t have to speak to them and you certainly don’t have to let them come inside your home.