Don’t Ignore A CCJ! Here’s Why You Should Respond

For free and impartial money advice you can visit MoneyHelper.

For free and impartial money advice you can visit MoneyHelper.

Are you worried about a County Court Judgement (CCJ)? You might be feeling scared about a bailiff coming to your home or stressed about your things being taken away. You’re not alone. Over 170,000 people come to our website seeking advice on their debt issues each month, and Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1.

This article will help you understand:

- What a CCJ is and why you might get one.

- How to stop a CCJ from being given to you.

- What happens if you don’t pay the debt the CCJ was for.

- How to deal with bailiffs if they come to your home.

- How to get a CCJ put to one side or avoid one completely.

We know this is a hard time for you, but we’re here to help you make sense of it all. Let’s get started.

Why Are You Issued a County Court Judgment?

How to Get A CCJ Removed

Our partners at the CCJ Removal Service have a ton of experience with getting CCJs removed.

They will cover the whole process for you – listening your story and advocating for you every step of the way.

The Process

Step 1:

- Establish your legal grounds for removal.

Step 2:

- Mediate with your claimant to establish the terms they’d agree to “Set Aside” the judgement under.

Step 3:

- A barrister drafts the agreement between the parties to get your CCJ removed.

Step 4:

- The court removes or “sets aside” the CCJ from your public record.

It’s a surprisingly simple process.

Fill out our form to get help from our partners at CCJ Removal Services.

What Happens if You Don’t Pay the Debt the CCJ Was Issued Against?

From my experience, some people wrongly think that CCJs can become statute-barred and therefore unenforceable. This is not the case.

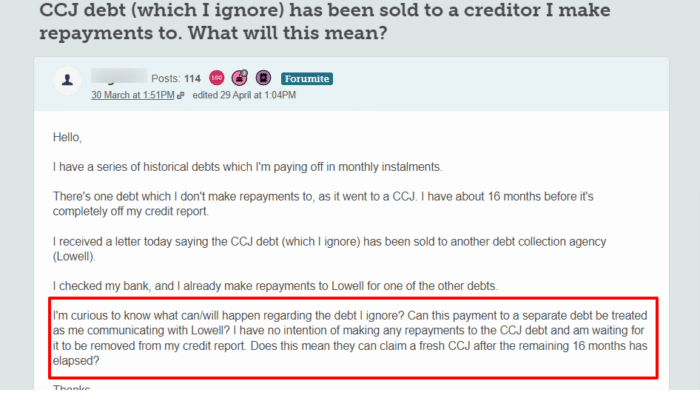

While this forum user is in a fairly complicated financial situation, they are right to wonder what will happen to the CCJ that they are ignoring.

CCJs don’t become statute-barred because your creditor has taken legal action to try and get their money back – they haven’t just ignored the situation. That said, your creditor will need to go back to court and get permission to enforce it if it has been 6 years since it was issued.

You might be able to successfully argue to the judge that they had 6 years to try and enforce it but didn’t bother, so why should they get the opportunity now? If you are in a situation like this, you need to seek legal advice. Contact any of the charities that I have listed at the bottom of this page for free advice.

Dealing With Bailiffs Visiting Your Home

What if I am a vulnerable person?

Before you start addressing the potential bailiff action, you should know that if you:

- Are disabled in any way or extremely ill

- Suffer from any kind of mental illness

- Have children or are pregnant

- Are under the age of 18 or over the age of 65

- Are dealing with a stressful situation such as the death of a loved one or unemployment

- Don’t speak English very well

You are considered a vulnerable person. This means that any bailiffs will have to follow some additional rules to ensure their visit is as easy on you as possible.

Furthermore, if any of these conditions apply to you, you can get more time to deal with the Notice of Enforcement. You can also get more time if the Notice of Enforcement was not sent to you properly by the bailiffs.

If you fall into any of the above categories, you need to either tell the bailiffs yourself or get a relative or carer to do it for you. You can then contact them by phone or by post. I have a free letter template that you can use to explain your situation.

When you speak to the bailiffs, you need to:

- Tell them that you’re vulnerable

- Explain why you would find dealing with bailiffs more difficult than other people in the same situation

- Ask them to stop any visits in the future because it will cause harm and distress to you

- Tell them if a letter or a visit could make your situation worse – this could be the case if you have a mental health problem or a heart condition, for example.

Make a note of what you agree with the bailiffs about future contact. This will make it easier to argue with them if they don’t stick to this new agreement, or if you need to make a complaint.

I recently shared some important rights you have with bailiffs in an interview with the Mirror. Here’s a quick table summarizing the key aspects.

| Bailiffs Can | But They Can’t |

|---|---|

| Call and visit your home multiple times, any day of the week. | Visit your workplace (if you are not self-employed) |

| Take items from your home. These items have to be considered ‘luxury’. | Take essential items from your home. This includes beds, clothing, and work equipment. |

| Use ANPR technology and DVLA information to locate your car and take it. | Enter your home without permission unless they have a warrant to force entry for a CCJ. |

| Peacefully enter your property. | Harass or threaten you. |

| Issue notices to those who owe a debt. | Take items that belong to someone else. However, they may be able to seize jointly owned property. |

| Offer to conduct a Virtual Controlled Goods Agreement (rather than in-person). This will typically be offered to vulnerable people. | Sell goods they have seized at auction until seven clear days have passed. |

Can I get a CCJ Set Aside?

Yes, a CCJ can be set aside but you need to do some admin work and attend court.

You can apply for a CCJ to be set aside using an N244 form. On this form, you fill out all the reasons why you think your CCJ is invalid and should be set aside. You need to submit this form to the relevant court and pay the court fee of £275.

A hearing will then be scheduled if there is a valid reason why your CCJ can be disputed. If you successfully plead your case at the hearing, your CCJ will be set aside. This basically means that it is cancelled and you don’t have to pay it.

What Debts Can Lead to a CCJ?

Basically, any unsecured debt that you don’t stick to the agreed payments on can lead to a CCJ. This means that any unsecured debts you don’t pay at all, or unsecured debts that you pay some of or part of your agreed payments.

An unsecured debt is any debt that is not backed by an asset. Unsecured debts include, but are not limited to:

- Credit card debt

- Catalogue debt

- Utility bill debt

- Overdraft.

Secured debts, on the other hand, are debts that are backed by an asset. For example, a mortgage. Your creditor couldn’t get a CCJ against you if you hadn’t paid your mortgage because they can repossess your house and cover their losses that way.

» TAKE ACTION NOW: Fill out the short debt form