CCJ Sent to Old Address – Your Defence

For free and impartial money advice you can visit MoneyHelper.

For free and impartial money advice you can visit MoneyHelper.

Are you worried about a CCJ sent to your old address? Are you scared about a bailiff knocking on your door or taking your things?

Don’t worry. You’re in the right place for answers. Over 170,000 people visit our website each month for guidance on debt issues, just like yours.

This article will help you understand and deal with this tough situation. We’ll cover:

- What a CCJ is and how to find out where it was issued.

- How to get a copy of your credit record.

- What steps you should take if you come across a CCJ.

- How to seek legal advice and possibly write off some debt.

- What happens if the claimant was not told about your new address.

Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1. So, being concerned about debt and its implications is common.

In fact, some of us here at MoneyNerd have faced debt collectors too. We know how it feels, and we’re here to help you.

Let’s dive into learning more about managing a CCJ sent to an old address and protecting your credit file.

What is a CCJ?

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.

If you manage to pay within one month of the CCJ being issued, the judgement will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

What happens if the claimant wasn’t told your new address?

Your Rights With Bailiffs

It’s crucial to understand your rights when dealing with bailiffs. That’s why I’ve put together this table that explains what bailiffs can and can’t do. For more information, don’t forget to read our detailed guide.

| Bailiffs Can | But They Can’t |

|---|---|

| Call and visit your home multiple times, any day of the week. | Visit your workplace (if you are not self-employed) |

| Take items from your home. These items have to be considered ‘luxury’. | Take essential items from your home. This includes beds, clothing, and work equipment. |

| Use ANPR technology and DVLA information to locate your car and take it. | Enter your home without permission unless they have a warrant to force entry for a CCJ. |

| Peacefully enter your property. | Harass or threaten you. |

| Issue notices to those who owe a debt. | Take items that belong to someone else. However, they may be able to seize jointly owned property. |

| Offer to conduct a Virtual Controlled Goods Agreement (rather than in-person). This will typically be offered to vulnerable people. | Sell goods they have seized at auction until seven clear days have passed. |

How to Get A CCJ Removed

Our partners at the CCJ Removal Service have a ton of experience with getting CCJs removed.

They will cover the whole process for you – listening your story and advocating for you every step of the way.

The Process

Step 1:

- Establish your legal grounds for removal.

Step 2:

- Mediate with your claimant to establish the terms they’d agree to “Set Aside” the judgement under.

Step 3:

- A barrister drafts the agreement between the parties to get your CCJ removed.

Step 4:

- The court removes or “sets aside” the CCJ from your public record.

It’s a surprisingly simple process.

Fill out our form to get help from our partners at CCJ Removal Services.

How do you check if you’ve got a CCJ?

What if I ignore a CCJ?

Ignoring a CCJ, even if you think there’s been a mistake, is not a good idea.

If you just ignore a CCJ, fail to respond to the CCJ letter, or fail to make a CCJ payment plan will result in further action.

The court might send a bailiff to enforce the CCJ and collect the debt. Baillifs will inform you that they are going to visit 7 days in advance, but they will add fees to your debt.

Our financial expert, Janine Marsh, advises: ‘If a bailiff has proven you owe money and you don’t have cash to hand, you’re within your rights to suggest a payment plan. It’s not a guarantee, but many will accept this as it’s easier than repossession.

However, if you aren’t able to make a repayment plan with the bailiff or don’t stick to the plan, they can take your belongings.

If you don’t let the bailiff in, they can’t force entry but they might be able to take things that are outside, like your car.

But the court might not send a bailiff and might take money from your monthly earnings. They could also make you bankrupt if you owe more than £5,000, or take money from the sale of property.

The court can also compel you to go to a hearing. There you will discuss your income and how you can pay off the debt. You must go to this hearing or you can be imprisoned.

» TAKE ACTION NOW: Fill out the short debt form

What should you do if the CCJ is valid?

Should you contact the Court?

Can a court find your file?

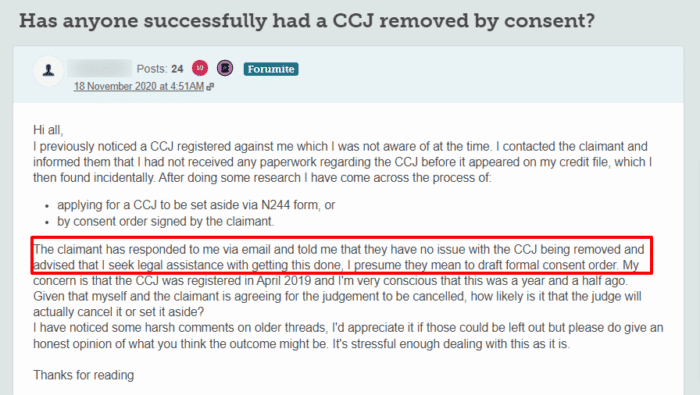

What are the chances of a CCJ being set aside?

Can the claimant agree to setting aside a CCJ?

What happens when a CCJ is set aside?

How do you find where a CCJ was issued?

CCJ sent to the old address, what should you do? RECAP

Should you seek legal advice?

If you are concerned about the cost of getting legal advice, you do have options:

- Debt charities: debt charities offer free legal advice for debt-related matters. I have linked a few charities at the bottom of this page.

- Solicitors’ firms: many firms offer a free 30-minute first consultation.

- Law clinic: your local university may have a law clinic that will offer legal services.

- Legal aid: legal aid might be able to cover your legal costs