Housing Benefit Overpayment Not My Fault – Write Off Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a housing benefit overpayment that wasn’t your fault? This is a common problem that many people face. Over 170,000 people just like you turn to our website each month to find guidance on their debts.

In this article, we’ll give you clear and easy-to-understand advice on:

- What a housing benefit payment is.

- How housing benefit overpayment happens.

- What to do if you get a letter about overpayment.

- What could happen if you don’t pay back the overpayment.

- How you might be able to write off some or all of the debt.

We know how stressful it can be when you’re asked to pay back money that you don’t think you owe. We’re here to help you understand what’s going on and what you can do about it. You’re not alone in this, and there are steps you can take to sort it out.

We’ll also talk about how to deal with other types of debt and when it might be possible to have some or all of your debt written off.

Let’s dive in and discuss your options.

What is a housing benefit payment?

Housing benefit is a type of state benefit payment that helps people pay their rent. It’s available to people who are unemployed or are on a low income.

You can only make a new claim for housing benefits in specific situations. Check if you qualify for housing benefit payments on the government’s dedicated housing benefits page.

What is a housing benefit overpayment?

A housing benefit overpayment is when you receive housing benefit payments but have been paid more than you should have.

There could be many reasons why you have been overpaid housing benefits. But the most common is failing to update a change of circumstances that can affect how much you should receive.

Some of the circumstances you need to report are:

- A change in employment status to you or any person who lives with you

- A change in your savings and investments

- Having a baby or a death

- A child turning 18 years old

- Changes to your rent

You’re allowed to ask for evidence of a housing benefit overpayment within one month of receiving the notice. The council must then provide this information within 14 days.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

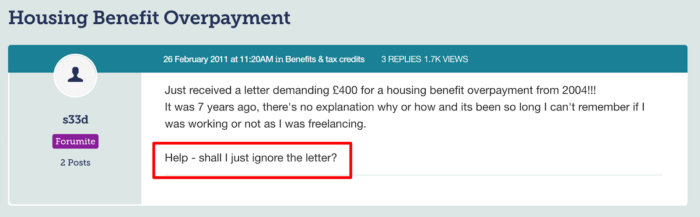

Can you ignore a housing benefit overpayment letter?

No, you shouldn’t ignore any letter telling you that you’ve received too much of a state benefit.

There can be serious consequences for ignoring a housing benefit overpayment letter, but you’re certainly not alone in considering ignoring it.

See here:

Source: https://forums.moneysavingexpert.com/discussion/3077842/housing-benefit-overpayment

To stress this point further, you need to know the consequences of ignoring a housing benefit overpayment…

What happens if you don’t pay back housing benefit overpayment?

If you owe housing benefit overpayment debt but refuse to pay, the council can take further action. They could recover the debt by using bailiffs or have money taken from your wages or state benefits.

Before further action is taken, they could try using a debt collection agency. One example of such a company is Cabot Financial. They’re not the same as bailiffs but they can still be stressful to deal with.

Housing benefit overpayment – not my fault!

Sometimes a housing benefit overpayment might not be your fault. In other words, the overpayment wasn’t the result of failing to update your information with the DWP.

You’re probably wondering if you have to pay a housing benefit overpayment when it was made due to an official error, i.e. not your fault.

The answer isn’t so black and white, as explained by National Debtline.

You will be expected to repay the overpayment if you could have easily recognised the overpayment and ignored it. But if the overpayment wasn’t easily recognisable, you might not be asked to repay.

But proving that you weren’t able to recognise the overpayment could be difficult. In this situation, you would need to communicate with the council and possibly raise a formal dispute.

How do I dispute a benefit overpayment?

The process to start an HB overpayment dispute is called a revision.

You usually have one month to ask the council for a revision, which is a second look at the circumstances leading to the overpayment and whether it was your fault.

You get a second month to raise this HB dispute if you requested information from the council as to why the overpayment was made, which can be done in the first month.

There is also a possibility to raise the dispute up to 13 months after the overpayment decision, provided you can explain why your dispute has been lodged so late.

If the council decides that you still need to repay the overpayment but you still don’t agree, there is a course for further action. You can ask for a first-tier tribunal for a second decision, which the council should explain when they notify you of their first appeal decision.

» TAKE ACTION NOW: Fill out the short debt form

Housing benefit overpayment appeal letter template

MoneyNerd makes the housing benefit appeal process a little easier with our free letter template.

Use our housing benefit overpayment appeal letter template for free to save you time and worry when lodging a dispute.

Can benefit overpayment be written off?

In very rare cases, the council will agree to have a housing benefit overpayment written off. They will only do this if you can evidence extreme financial hardship.

Can housing benefit overpayment be written off when it’s not your fault? (Recap!)

There’s a chance you won’t be forced to repay a housing benefit overpayment when it genuinely wasn’t your fault. But you’ll also need to prove that it wasn’t easy to notice that you received an overpayment as part of a dispute. This can be challenging.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Related FAQs

What happens if Universal Credit overpayment is not my fault?

The DWP will aim to recover a Universal Credit overpayment regardless of the reasons the overpayment was made in the first place.

However, you might be able to agree on a repayment plan so the overpayment doesn’t cause financial hardship.

Do you have to pay housing benefit overpayment over six years old?

Unfortunately, according to National Debtline the answer is yes.

Housing benefit overpayments can become statute barred after six years, which means they’re too old to be enforced by a court. But the council doesn’t need to take you to court to enforce a debt with bailiffs or by having money deducted from income.

So you will need to pay old housing benefit overpayment debts as well!

How can I write off my debts?

There are several ways that a debt or multiple debts can be written off. We discuss all the possibilities in our Write Off Debt guide. Check it out now for help clearing your existing arrears and debts.