How Long Before an Unpaid Debt is Written Off?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about an old debt? Wondering how long before it can be written off? Well, you’re in the right place for answers. Each month, over 170,000 people visit this site for advice on debt matters.

In this article, we’ll explain:

- The law in the UK about debts that are over six years old.

- If and when you can still be asked to pay this debt.

- What to do if you’re unsure about an old debt.

- The right way to handle debts you didn’t make.

- Where to find free and good advice about debt.

A study by Citizens Advice found evidence of poor practices by debt collectors in the UK, including the collection of very old debt.1 So, I understand your worries.

But you’re not alone. We’ll show you what you can do and how to make the best choices.

How Long will it Take for My Debt to be Removed?

The limitation period for most types of unsecured debts is six years. This mainly applies to debts such as credit cards, payday loans, personal loans, catalogues, etc.

There are some secured debts that have different limitation periods. For example, mortgage shortfalls have a limitation period of twelve years.

Keep in mind that once the limitation period has been completed, the debt becomes unenforceable but it still technically exists.

This means that while your creditor will not be able to pursue court action against you, they can still take other actions to recover their debt from you.

If your creditor is authorised and regulated by the Financial Conduct Authority, then FCA guidelines state that they are not allowed to contact you if your debt has become statute-barred.

Thus, if your debt has become statute-barred and a creditor that operates under FCA guidelines is attempting to contact you regarding your debt, then you can make a complaint to the FCA.

However, if your creditor does not operate under FCA guidelines, then they may contact you and attempt to recover their debt from you even after it has become statute-barred.

They still can’t take you to court, of course, but they are allowed to contact you and take other actions to recover their debt unlike creditors operating under FCA guidelines.

» TAKE ACTION NOW: Fill out the short debt form

You must also keep in mind that if you get a County Court Judgment (CCJ) taken out against you before your debt is statute-barred, then this prevents that debt from ever becoming unenforceable.

Another thing to be aware of is that there are certain types of creditors that don’t even need the help of the court in order to take action to recover their debts from you, e.g. tax credit overpayments or debts to the Department of Work and Pensions (DWP).

Organisations such as HM Revenue and Customs can take money straight out of your wages and benefits in order to make up for your debt.

They can do this without ever needing to go to court.

So, even if your debt has become statute-barred, it won’t matter.

You can also still be legally contacted for council tax bills even if the last payment you made was six years ago. It’s also extremely unlikely that your local council will allow your debt to reach six years or over.

This is why you should always treat priority debts such as council tax debt, income tax debt, etc. very seriously.

They have very dire consequences if you ignore them.

Will Statute-Barred Debt Affect My Credit Rating?

Yes, statute-barred debt will affect your credit rating, but probably not in the way you think!

Credit rating and unpaid debt are linked so your credit rating will get lower, even if your creditor agreed to your reduced payments.

Any reduced payments, missed payments, or defaulted debts are recorded on your credit file. These will stay on there for six years. However, any open accounts will remain on your credit file indefinitely.

This means that they will be visible to other lenders as ‘open,’ even if they become statute-barred.

While this may not necessarily drag your credit score down dramatically, many creditors will be reluctant to give you credit. This is because you are now marked as someone who does not repay their debts or has had difficulty repaying their debts in the past.

You will probably find that you are offered higher interest rates or are subject to larger initial payments when offered credit.

There are products designed specifically for those with poor credit histories which can be used responsibly to help put some positive credit history back onto your file.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Once a Debt is Statute-Barred, Does it get Removed from My Credit File?

The time period after which the mention of debt is removed from your credit file is six years after your default notice.

As I mentioned earlier, it also takes six years after your last acknowledgement of the debt for it to become statute-barred.

An acknowledgement of your debt can be any payment or a written communication about it.

Should I just Ignore Payments for Six Years until the Debt is Written Off?

No.

Many people consider this limitation period a solution to their debt problem but the truth is that it hardly ever works for anyone. It should not be considered a debt solution.

In most cases, your creditors will not let six years go by without taking some sort of action against you if you’re refusing to make your payments.

Once you stop making payments towards your debt, your creditor will send you a default notice which will inform you that if you don’t resume making payments towards your debt, then they will take action against you.

This action would most likely be taking out a County Court Judgment (CCJ) against you. You are usually given 14 days to respond to the default notice.

I highly suggest that if you get a default notice, you should make a payment towards your debt and then continue making payments as your creditor requests. Once a CCJ is issued within six years of you acknowledging the debt, it can never be statute-barred.

If you cannot afford to make the payments that your creditor has stated, you should still contact them and tell them.

Many creditors will be open to negotiating a different repayment plan that you will be able to afford.

If you do get a different repayment plan, make sure you get it in writing.

This will make it easier for you to keep an accurate record of your debt repayment.

You should never ignore your creditors in hopes that they will somehow forget about your debt and not take any action for six years. In most cases, ignoring them will end up in you getting a CCJ taken out against you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Do I Talk To My Creditors?

Regular communication with your creditors is important, especially if you are having financial troubles.

You may need to talk to your creditors to create a repayment plan that works for you. But speaking to creditors can be scary when you don’t know how!

From my experience, it is best to start with your priority creditors.

These are creditors who cover essential areas of your life, like your utility company, your mortgage provider, or your landlord.

You will need to be able to demonstrate why you need them to reduce your monthly payments. Usually, creditors will ask to see a budget for your household that includes your income and your living costs.

Keep in mind that most creditors will only agree to a reduced payment scheme for a set period of time. They will then assess your financial situation to see if it has improved and if you can start to pay them more.

Don’t hesitate to contact someone who can help! There are several organisations that offer free debt advice in the UK.

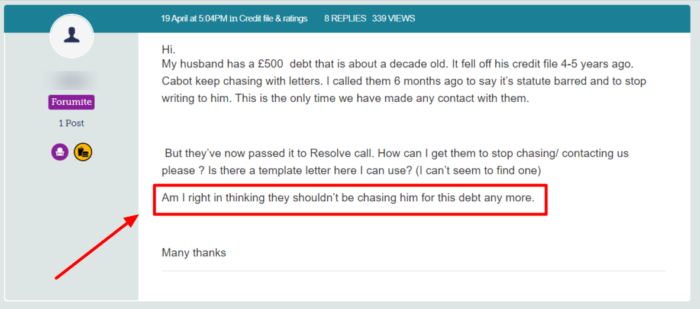

But sometimes you will need to tell your creditors that they are wrong and they can’t be chasing you for old debts!

This person should consider making a complaint to the FCA or even the Financial Ombudsman Service. Cabot and Resolvecall should not be contacting them over this old debt – unless a CCJ was issued years ago!

I Made a Payment Towards My Debt after Six Years. Have I Made it Enforceable Again?

This depends on what type of debt it is.

If it’s an unsecured credit debt, then the limitation period for it is six years. So, if you made a payment after six years, then it would still remain unenforceable.

There is nothing that you can do that will reactivate an old unsecured debt.

However, other debts such as mortgage shortfalls have a limitation period of twelve years. If you were to submit a payment towards it after 6 years, then it would definitely refresh the limitation period.

This would mean that it would take another twelve years for the limitation period to be completed for it.

Remember that the timer for statute-barred debts starts from the date of your last acknowledgement of it.

This could be the date that you made the last payment on your debt, or your last written communication about it.

The bottomline is that once the appropriate limitation period for the type of debt has been completed, then it becomes irreversibly unenforceable. You making payments towards it after it has become unenforceable does not make it enforceable again.

Where Can I Get Advice For My Debt?

If you are struggling with your debt, I always recommend talking to a debt charity.

These organisations can offer free and individual financial advice to help you get back in control of your finances. You may even benefit from a debt solution which will be explained to you in more detail.