JB Leitch Solicitors Debt Collection – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Getting a letter from JB Leitch Solicitors Debt Collection may seem worrying, but you’re not alone. Every month, over 170,000 people come to our website for help with debt matters, just like this one.

In this article, we’ll help you with:

- Understanding who JB Leitch Solicitors are and why they’re contacting you.

- Figuring out if you need to pay the debt they’re asking for.

- Possible ways to stop JB Leitch Solicitors from taking further action.

- Knowing your options if you can’t afford the debt.

- Steps to take if you feel you’re being harassed by JB Leitch Solicitors.

We know how it feels to be in your shoes- our team has had their fair share of experiences with debt collectors, too. So, we aim to give you clear, simple advice to help you figure out what to do next.

Ready to find out more about handling JB Leitch Solicitors Debt Collection? Let’s dive in!

Why are JB Leitch Solicitors Contacting Me?

Since this firm specialises in property management, they offer debt collection services for service charge arrears and ground rent arrears. Basically, they are one part of the landlord-debt collection process in the UK.

If you’ve fallen behind on either service charges or ground rent and owe your landlord money, they have likely employed JB Leitch solicitors Debt Collection to chase the debt on their behalf.

This usually happens if your landlord has made attempts to contact you but hasn’t been able to get in touch.

If you’re totally confused and pretty certain you don’t owe your landlord or property manager money, we’ll cover the steps you need to take later in this guide.

Is JB Leitch Solicitors Debt Collection a Scam?

In short, no. This firm is regulated by the SRA and is not a scam. So if you’re receiving letters or phone calls from this firm, don’t ignore them! They may end up escalating your case further, which can seriously harm your credit score in the long run.

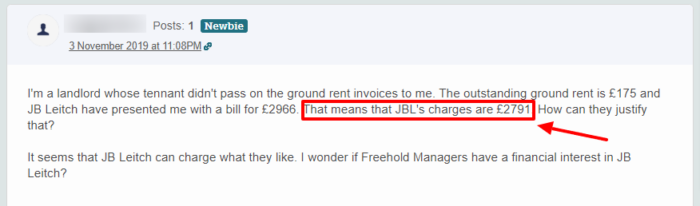

However, they do have a reputation online for pressuring people into paying bills and charging high fees. Here is a short review:

What Steps Do I Take When I Receive a Debt Collection Letter from JB Leitch Solicitors?

Before you even think about making a payment to these solicitors, make sure you follow these steps to ensure the debt they claim you owe is legitimate:

1. Check if the debt is in your name

The first step is to head to a reputable credit check site such as Credit Karma and see if the debt is listed under your name. If it is, it will show up on your credit report.

If it’s not there, the debt isn’t in your name, so there may have been a mistake on the part of JB Leitch or the creditor who hired them.

However, not all debts will be visible on your credit report. In these cases, you may need to contact your original creditor and ask if you owe them money or ask JB Leitch for proof that you are liable. You can do this with one of my free ‘prove the debt letter’ templates.

2. Ask the solicitors to prove the debt

A ‘prove the debt’ letter will include evidence of the original credit agreement with the lender.

For example, if they claim you owe missed service charge payments, they will need to show the original signed agreement of the service charges you owe.

They should always provide original copies of signed agreements as evidence.

3. Is the debt is Statute Barred?

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to XX and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

If you’ve done all of these checks and the debt is legitimate, it’s in your name and it’s within the statute of limitations, next you need to find the best option of paying the debt off.

» TAKE ACTION NOW: Fill out the short debt form

Should I Ignore Letters from JB Leitch Solicitors?

Definitely not. Responding to debt collection letters is essential, even if you don’t think that you have any debts.

Many people believe that if they ignore debt collection letters long enough, they will just go away. But remember, this firm was employed by a client, so they’re not going to give up.

Even if you dispute the debt, it’s always best to return the call or letter to JB Leitch solicitors and let them know you’ve received their correspondence.

Let them know that you need some time to look into the claimed debt yourself and will get back to them within 2-3 weeks.

Never admit to owing the debt either over the phone or in writing until you’ve confirmed it is your debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should I Just Pay JB Leitch Solicitors What They are Asking?

Ultimately, it is your responsibility to pay your debts. However, if you’re not totally certain the debt claimed is yours, you shouldn’t pay it upfront without question.

Instead, you should do your own due diligence to ensure the debt is in your name and you are legally responsible for it.

We’ll cover the steps you should take to do this later.

Also, even if you’re sure the debt is yours, if paying it back means going into more debt – don’t do it. There are options available to help you avoid further debt – we’ll talk about these later too.

What Legal Action Can JB LeitchTake?

1. Attempt to get in touch directly

JB Leitch Solicitors Debt Collection will begin by sending you a letter the debt owed, whom to, and how to pay the balance. If this goes unanswered, they will send follow-up letters and call you if they have a phone number on file.

2. Send agents for a home visit

It’s stressful having debt collection agents show up at your door, but these are not bailiffs. If you don’t reply to the letters or phone calls, an agent from JB Leitch will come to your address to attempt to reach you.

They have no right to enter your home without permission and must leave when asked. Do not agree to any form of payment with an agent on your doorstep. Simply let them know you’ll call or write to the firm directly within the next week.

3. Issue a County Court Judgement

The solicitors can take your case to court on behalf of their client if you refuse to make payments. A County Court Judgement is issued by a judge and legally compels you to pay back the debt owed.

If you strongly believe you don’t owe the debt, or JB Leitch solicitors haven’t given you adequate time to make arrangements directly, you can apply to have the County Court Judgement cancelled.

4. Send bailiffs

Bailiffs will be sent to your home to recover goods if no payments are made after a County Court Judgement is filed.

Learn more about how to deal with bailiffs here.

5. Apply for an Attachment of Earnings Order

An Attachment of Earnings Order takes the debt owed directly from your wages every month until it is paid in full (usually with interest and fees).

This only applies if you have a salaried job. If you are self-employed, retired or not working, this cannot be issued against you.

Can JB Leitch Debt Collection Repossess My House?

If you own your home, JB Leitch might file a Charging Order. If payments aren’t made, your home can be repossessed to pay the debt.

This is a rare occurrence, and there are many steps before this action is taken, so don’t stress about your house being taken if you’re at the beginning of the steps above.

Charging Orders also only tend to happen as a last resort for secured debts, because the repossession process in the UK is expensive! Unsecured debts, including service charges or ground rents – which JB Leitch appears to specialise in – are much less likely to have a Charging Order associated with them.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Do I Do if JB Leitch Solicitors Are Harassing Me?

Unfortunately, it’s impossible to stop JB Leitch solicitors from contacting you completely until you pay the debt that you owe. They have a legal obligation to their client to make reasonable attempts to contact you to recover the debt.

Having said that, solicitors and other debt collectors are not allowed to harass you or pressure you into paying a debt you can’t afford.

Make a Complaint Against JB Leitch

If they have done any of the points in the list above, you should first file a complaint with the firm directly. You can contact them using the following details.

Post: JB Leitch Solicitors, 10 Duke Street Liverpool, L1 5AS

Telephone: 0151 708 2250

Email: [email protected]

What Do I Do if I Can’t Afford My Debt?

Perhaps your circumstances have changed, and you’ve fallen behind on payments you once made. Or perhaps you weren’t even aware that you owed this money but are in financial distress and can’t afford ot pay it.

Either way, there are some options to pay back the debt without getting into more financial hardship. Here are just some of your options:

1. Agree on a payment plan

Your first step should be to contact JB Leitch and explain your situation. They should give you options for a monthly payment plan or even a reduced amount if the lender allows.

Before you call the solicitors, write down your monthly outgoings and budget to figure out how much you could comfortably afford to repay each month.

Never agree to a monthly amount that you can’t afford to repay.

If you can’t agree on a monthly repayment plan, ask if the lender would agree to a reduction in the amount owed.

This might mean you can afford to pay the debt off in one lump sum.

If you do come to an agreement, make sure there are no hidden fees or added interest – these are often added in and significantly inflate the amount owed.

2. Explore your debt management options

If you can’t come to an agreement on a repayment plan or a reduced figure, let JB Leitch know that you need some time to explore your options.

They should then give you at least two weeks without pestering you with more letters or phone calls.

I recommend speaking to a debt charity for some free financial counselling and debt advice. Their advisors will be able tow alk you through your options in detail and find the best way forward for you.

I have linked a few charities at the bottom of this page.

The Snowball Method

If you have several debts and you’re struggling to pay them all each month, the snowball method is a great option.

This is a debt repayment method that focuses on the smallest debt first and eventually builds up to your largest debt. Many people find this system is the best way to manage large amounts of debt quickly.

Learn more about the Snowball method here.

Start a Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Apply for an IVA

An Individual Voluntary Arrangement is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Find out more about an IVA here.

VAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Apply for a Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

File for Bankruptcy or Sequestration

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration is the Scottish version of bankruptcy.If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

How Do I Make a Complaint About JB Leitch Solicitors?

If you think that JB Letich Solicitors has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to JB Leitch so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, JB Leitch Solicitors may be fined. You could even be owed compensation.

JB Leitch is also regulated by the Solicitor’s Regulation Authority (SRA). This means that they must also follow all SRA guidelines. You can follow the complaint process to the SRA and make another secondary complaint if you are unhappy with the way that they have behaved towards you or if you think that they have broken any SRA guidelines.

You could also make a complaint to the Legal Ombudsman. However, they tend to work primarily with the customers of solicitor’s firms, rather than those being chased by them.

JB Leitch Solicitors Contact Information

Looking for More Debt Management Options?

If none of these options quite suit your circumstances, there are more options available. Head to our debt management guide which gives more detail on the different routes you can take to get yourself out of debt as quickly as possible.

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.