For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about bailiffs coming to your door, you’re in the right place. We’re here to help you understand your rights and explain how you can stop bailiffs from visiting your home.

Every month, more than 170,000 people visit our website to find answers to their debt problems, so you’re not alone.

In this article, we’ll explain:

- Who bailiffs are and the different types.

- How and when they can collect a debt.

- What you can do if a bailiff is coming to your home.

- What happens if you can’t pay the bailiff.

- How to complain if you’re not happy with how a bailiff has treated you.

We know that dealing with debt and bailiffs can be very stressful, as some of our team members have been in your shoes – we understand what you’re going through. Let’s dive in and find out how you can take control of your situation and beat the bailiffs.

Who are bailiffs?

A bailiff, also known as an enforcement agent, is a professional who is given authority to carry out requests of a court. They’re usually charged with recovering debts that were ordered to be paid by a County Court or The High Court. But they can also be tasked with arrest warrants or asked to serve court documents.

Although many people know these people as bailiffs, they’re known within the industry as enforcement agents.

What is a County Court bailiff?

County Court bailiffs are enforcement agents that work to recover debts that were ordered to be paid by the local County Court via a CCJ. The bailiff uses a Warrant of Control to allow them to visit people at home and request they pay – or take control of possessions to be sold.

What is a High Court Enforcement Officer?

A High Court Enforcement Officer is an enforcement agent that works for the High Court to recover debts and unpaid criminal fines that have been ordered to be paid by the High Court. They use a High Court Writ of Possession to carry out the recovery of debts and fines.

The legal powers of a High Court bailiff are comparable to that of an enforcement agent pursuing debts ordered to be paid by the County Court. But there are some differences.

What is the difference between a bailiff and a debt collector?

A debt collector isn’t the same as a bailiff. Debt collectors are companies – which also go by the name of debt collection agencies – used to help businesses recover a debt before litigation and a court order is made.

Debt collection businesses have no additional powers than the creditor. They cannot come inside your home or suggest they can. But they use persistent methods to get debtors to pay, including making legal threats.

When can a bailiff collect a debt?

A bailiff can only collect a debt when the debtor was told to pay via a court order and hasn’t done so. This includes unpaid County Court Judgments and unpaid High Court debts.

When the debt remains unpaid, the court grants the claimant permission to enforce the unpaid debt by employing the services of bailiffs.

To get to this stage, you must have defaulted on a debt and then been issued a court order, usually a County Court Judgment (CCJ). The amount owed can be increased by a judge to include interest, as per Section 69 of the County Courts Act.

A defaulted account and a CCJ are two different steps in the process. A default alone cannot result in the use of bailiffs. The court order must have been served.

If you receive a CCJ and pay the debt within one month, the CCJ will be discharged and you’ll never have to deal with bailiffs regarding this debt.

But if you don’t pay or default on a payment plan after the CCJ was issued, the creditor can ask for a warrant to enforce the debt with bailiffs. Only at this stage can a bailiff company become involved.

» TAKE ACTION NOW: Fill out the short debt form

What debts do bailiffs collect?

Certificated enforcement agents can work to collect a wide range of debts once a judge gives the claimant permission to use bailiffs. Some of the common types of debt that are collected by bailiffs are:

- Personal loans

- Credit card

- Private parking fines

- Catalogue arrears

- Store card debt

- Council tax debt

- Court fines

- HMRC debt

We’ve discussed dealing with many of the debts listed above already. You can find specific support and guidance dealing with these debts via our debt info hub.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Bailiff companies

The MoneyNerd team has already researched many court bailiff companies operating throughout the UK. We’ve written about these companies so you know what to expect. Find the bailiff company you have to deal with and learn more in our review guides.

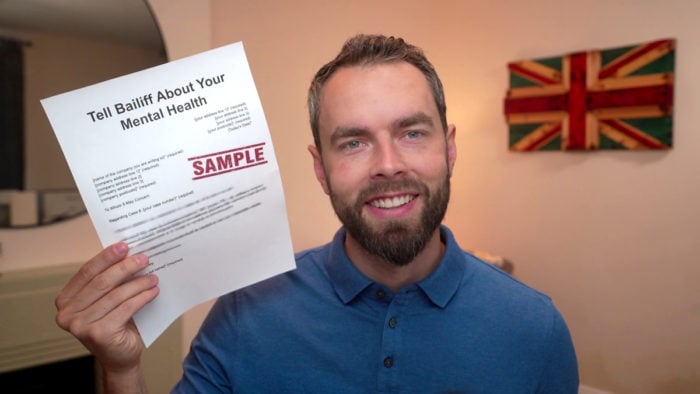

What can I do if I receive a notice to say a bailiff is coming to my house?

Before bailiffs visit you, they must send a Notice of Enforcement letter which explains that they are now in charge of recovering the debt.

The letter will encourage you to get in touch to make payment arrangements, usually to pay in full. Once seven clear days pass since the letter is received, the bailiffs are allowed to visit your home.

There are ways to stop the bailiff from turning up at your door…

What if you can pay the bailiff?

If you can afford to pay the bailiff in full or can offer an initial lump sum and a payment plan when you receive the Notice of Enforcement, it’s important to make contact immediately.

Call the enforcement agents using the number provided on the letter to pay or to agree on a payment arrangement.

This will stop the bailiff from having to visit you, and will also avoid at least another £235 fee being added to your debt.

Can I stop bailiffs from coming?

It’s possible to stop a bailiff from coming into your home even when you can’t afford to pay the debt or agree on a payment plan in advance.

Certain vulnerable people and situations can prevent a bailiff from attempting to come inside your home. You should let the bailiffs know about your situation and why they cannot visit you as soon as possible.

Some of the reasons that can stop bailiffs from coming inside are that you’re alone and:

- You’re disabled

- You’re seriously or terminally ill

- You have severe mental health problems

- You’re pregnant

- You don’t understand English well

If bailiffs discover they cannot come into your home under any circumstance, they are likely to pass the debt recovery process back to the creditor.

What if you can’t pay the bailiff?

If you can’t pay the enforcement agent company, you should expect them to come to your home and ask you to pay in person or get a friend or family member to pay for you.

Otherwise, they will seize possession of any goods you own and sell them at an auction. The sale proceeds of your goods will be used to clear the debt, which will have grown due to added bailiff fees.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long does it take for bailiffs to come?

Bailiffs can come after seven clear days of sending the Notice of Enforcement, but this doesn’t mean they will definitely come as soon as they’re allowed. They might come as soon as possible, or they could wait an extra few days.

Where can bailiffs visit you?

Bailiffs visit you at any address where you live or run a business. However, they’re most likely to visit you at home for personal debts because business assets cannot be used to clear personal debt.

This is because you and your business are classified as separate entities – unless you operate as a sole trader.

If bailiffs become aware that you have stored your goods at a different address to try and avoid them being taken, such as a friend’s house, they can go to their address instead. But before they can visit the other property, the bailiff is required to get a warrant from the court.

Can a bailiff come to my work?

A bailiff can only come to your place of work if you run your own business from this address. They cannot visit your workplace if you work for an employer.

But it’s much more likely that they will visit you at your home address.

When can bailiffs visit?

In the majority of cases, bailiffs can only visit you between 6am and 9pm. There are some exceptions, including:

- If the bailiff has a warrant to visit outside these times

- Or, if they visit a business that only operates outside of these hours

Do bailiffs work weekends?

Yes, some bailiffs will work on a weekend. They can visit your home between 6am and 9pm on a Saturday or Sunday. However, bailiffs should avoid visiting during religious or cultural holidays unless their visit is absolutely necessary.

If bailiffs turn up at my door, do I have to let them in?

You’re not obligated to let a bailiff into your home.

To prevent the enforcement agent from gaining peaceful entry into your home – possibly through an open doorway – you might want to communicate with them through the letterbox or an upstairs window.

What happens when bailiffs gain peaceful entry?

When a bailiff gains peaceful entry, they’ll talk with you and ask you to pay the full amount. If you tell them you cannot pay the full amount, they’ll ask what you can afford to pay.

In simple terms, the bailiff will be trying to work out the best result they can get from their visit, either by taking your money and agreeing on a payment plan, or by taking control of your goods.

It’s normal for bailiffs to work in twos. One bailiff might start talking to you about the debt and payment, while the other will start scanning your property for assets that could be seized, simultaneously working out what they’re likely to sell for.

Can bailiffs force entry to my premises?

In the majority of circumstances, bailiffs cannot force entry into a premises and they must enter through an open or unlocked door.

There are limited times when a bailiff can force entry into a property, but this doesn’t mean pushing you out of the way or breaking doors or windows.

What can bailiffs legally do?

Bailiffs can legally enter your property to request payment or take control of goods. They can do this by entering unlocked and open doors. They cannot stop you from closing a door, push past you, or enter through a window.

There are limited exceptions as to when they can enter less peacefully. These are:

- When they have a warrant to enter with force (extremely rare and usually reserved for court fines and HMRC debt!)

- When they need to take control of goods listed with a Controlled Goods Agreement (there are some caveats to this rule)

A Controlled Goods Agreement (CGA) is an agreement you enter into with bailiffs when you agree to a payment plan. It states that the bailiffs are allowed to seize specific assets if you fail to keep up with payments to the bailiff company.

If you default on one of these payment plans, the certificated enforcement agent can come back to your property and use force to enter the property to take possession of the items listed in the CGA.

However, they can only do this if they previously gained entry to your property peacefully. If a CGA was made without bailiffs entering your property, they cannot use additional force to enter your home.

Can bailiffs force entry with a locksmith?

Yes, bailiffs can use a locksmith to enter your home to seize goods listed within a (defaulted) CGA. But they can only do this if they previously gained entry to your property peacefully. If not, they can still only enter your property through an open or unlocked door.

The costs of the locksmith can be added to your debt.

» TAKE ACTION NOW: Fill out the short debt form

What paperwork should bailiffs give me?

Bailiffs should provide you with proof of their identity, proof of the debt they’re attempting to recover and evidence that they can come to your property to take possession of goods.

Do bailiffs need a warrant?

Bailiffs should carry with them a Warrant of Possession to come to your home and attempt to recover the debt. If you’re dealing with High Court Enforcement Officers, they will show you a High Court Writ instead.

Does a warrant need to be signed?

Warrants used by bailiffs don’t require a wet-ink signature. Most warrants will be shown to you on a device rather than in hard-copy form.

Do bailiffs need a court order?

The bailiff doesn’t need a court order, but the claimant they’re working on behalf of must have won a court order previously. There is an exception, however. Bailiffs working to recover HMRC debts can do so without a court order first being issued against the debtor.

Can bailiffs enter your house when you are not there?

Yes, bailiffs can enter your property when you’re not home, but they can only do this if a peaceful entry is possible or if someone else lets them inside.

This means they can only enter without your permission by using unlocked gates and doors. They cannot force entry into the home, and they cannot climb through open windows or use a landlord’s master key..

What will happen if I’m not home?

If you’re not home and the bailiffs do gain peaceful entry, they can seize goods that belong to you to be later sold and pay off the debt.

What if bailiffs cannot gain entry?

Bailiffs who fail to recover the money owed and fail to gain entry to your property may come back and try again.

If they fail to gain entry again, they could ask for a warrant to force entry in rare cases. But they’re more likely to pass the debt back to the creditor.

Will they be like the bailiffs I’ve seen on TV?

Bailiff TV shows have become popular on some TV channels and on streaming services like Netflix. Bailiffs might not be as pleasant and nice as they come across on some of these shows, mainly because they’re not being watched by millions of people.

However, that being said, there are many bailiffs who actually care about you and will show compassion and empathy when carrying out their job.

Can a bailiff refuse a payment plan?

Bailiffs can refuse a payment plan. They might prefer to take control of your goods if they notice you own valuable assets. They may also reject the payment plan if the creditor has instructed them to do so.

It’s more likely that a payment plan will be accepted if you offer to pay a lump sum straight away which covers a large percentage of the total debt.

What can a bailiff take?

Bailiffs can take goods owned by the debtor that they can physically touch. They cannot take control of goods they can see but not touch, such as seeing a TV through a window.

Generally, they will be interested in any assets that can be sold for a high enough price to clear the debt. They’ll usually target electronics, jewellery, vehicles and some types of furniture.

What can bailiffs not take?

Bailiffs cannot seize possession of goods that you need to maintain essential living, such as:

- Kitchen appliances and white goods

- Enough furniture to seat everyone who resides in the home

- A dining table

- Heating appliances

- Medical appliances

- A washing machine

- Beds and bedding

They also cannot take employment equipment, study materials, pets, consumables and property fixtures, such as kitchen cupboards or wardrobes. There are more complex rules about seizing vehicles, which we have covered in further detail later in this guide.

Can bailiffs take goods belonging to someone else?

Bailiffs cannot take control of goods belonging to another person or entity. They cannot take control of company assets even if you own the company, and they cannot take control of goods that belong to your children.

It’s not possible for a bailiff to try and take your goods for someone else’s debt either!

Can bailiffs take sofas?

Technically a sofa can be taken by bailiffs but the bailiffs must leave you enough furniture to cover your family’s basic needs. So there is a possibility that bailiffs won’t take your sofa.

Interestingly, a sofa can only be resold by the bailiffs if it has its fire safety label still attached. So the bailiff is unlikely to take possession of a sofa that doesn’t have this label attached anymore.

Can bailiffs take clothes?

Bailiffs won’t take possession of your clothes because these are deemed necessities.

Can bailiffs take my car?

Bailiffs can take a vehicle in your name provided:

- It’s not a mobility vehicle

- You don’t have a Blue Badge

- You don’t need it for work and it’s valued below £1,350

Bailiffs will usually look for your car first as this is likely to be one of the most valuable assets you own. And they’re more likely to look for your car on a driveway or the street if you’re unwilling to let them inside your home.

Can bailiffs clamp my car?

Bailiffs can clamp a car if it’s in a public place or on your property. They usually do this to make sure you cannot drive away while they wait for a truck to come and take the vehicle away.

To avoid your car being clamped and taken, you could park it in a locked garage or move it to someone else’s property.

However, if the bailiffs know you’ve moved your car to another property, they could apply for a warrant to take it from the other property. Moving your car between properties could prevent them from taking the vehicle easily.

How long can a Bailiff clamp my car for?

Bailiffs will clamp a car for a minimum of two hours before it’s removed by a truck. This means you’ll have at least two hours to pay the bailiff or get someone to pay for you. Otherwise, the vehicle will be seized.

Can bailiffs take goods on hire purchase or conditional sale?

No, bailiffs cannot take goods or vehicles that you don’t fully own yourself. If you’re still paying these assets off, such as a car on an HP Agreement, the bailiffs cannot take these because they’re not yours.

How do I stop bailiffs from taking my stuff?

You can stop bailiffs from taking your stuff by not letting them inside your home and by parking your vehicle in a locked garage or on private property not owned by you.

Although this stops the bailiffs from taking your belongings, it doesn’t deal with your debt problem. In fact, it could make things worse.

How many times can bailiffs visit?

Bailiffs should visit your home to attempt to recover the debt no more than three times. An attempt is only recorded when you’re home. So if you’re not at home or pretend not to be at home, that attempt won’t usually be counted as one of the three.

What can bailiffs do if you have nothing?

If you don’t have enough money to pay the bailiffs or agree to a payment plan, and you don’t own assets that can be used to clear the debt, bailiffs may refer the case back to the creditor. The creditor may then petition to make you bankrupt.

When can bailiffs sell goods that they have removed?

Bailiffs can only sell any goods they take possession of after seven clear days. The goods will be stored for seven days, giving the debtor an opportunity to clear the debt and take back the goods. Storage fees will be added to the debt by the bailiffs.

The goods are typically sold at a public auction. Sometimes goods are sold at these auctions for less than their real market value, which means they might not clear as much of the debt as you hope. On some occasions, the bailiffs will request to sell some items privately.

What fees can bailiffs charge?

Bailiff fees are fixed by the law. We have summarised these in the table below:

| Bailiff service | Cost |

| Sending the Notice of Enforcement letter | £75 |

| First visit to your property | £235 + 7.5% of the debt value over £1,500 |

| Removal of goods | £110 + 7.5% of the debt value over £1,500 |

Source: https://www.stepchange.org/debt-info/bailiffs/bailiffs-fees-and-costs.aspx

If your goods are stored and sold, there can be storage costs and auction costs added to your debt as well.

How do I complain about a bailiff?

To complain about a bailiff, you must send your complaint to your creditor who instructed the bailiff to recover the debt. But you need to send a copy of the complaint to the bailiff as well.

The complaint letter must include four pieces of information. These are:

- Your identity

- The identity of the bailiffs or a specific bailiff you want to complain about

- An explanation of why you want to complain, i.e. what they did wrong

- How you expect them to deal with the complaint

You should state that you want a response within 10 working days.

Can the police get involved with bailiffs?

The police can both assist bailiffs or remove them from a property. They will assist a bailiff to carry out their job if they have the right to remove goods but are being threatened or are in danger.

On the other hand, they can remove bailiffs from a premises if the bailiff cannot provide evidence of authority to carry out their actions.