For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about Dukes bailiffs payment or your debts being passed to a debt collector, you’re in the right place. This article will help you understand your rights and give you the information you need to handle debt collectors.

Here’s what you’ll learn:

- What a debt collection agency is, and how it works

- The difference between debt collectors and enforcement officers (bailiffs)

- How to handle a debt that’s been passed to a collection agency

- What to do if a collection agency is contacting you about a debt that isn’t yours

- Where to get help if you’re struggling with unaffordable debt

We know this can be a tough time, but you’re not alone. Over 170,000 people visit our site each month seeking advice on debt problems.

We know how stressful dealing with debt collectors can be. That’s why we’re here to help you find out more about your rights and how to deal with debt collectors in the UK.

What is debt collection?

Debt collection is the process of recovering unpaid debts owed to an individual or company. Some of the most common types of debts that people are chased to pay are:

- Personal loan arrears

- Credit card arrears

- Utility bill arrears

- Mobile phone arrears

- Council tax debt

- HMRC debts and tax credit overpayments

- Rent and mortgage arrears or mortgage shortfall

A strict process must be followed when collecting debts in the UK, and sometimes this task is outsourced to dedicated debt collection agencies who specialise in debt recovery.

What is a debt collection agency?

A debt collection agency is a commercial business that offers services to help other people and businesses recover money owed to them. Debt collection agencies usually provide services to track down debtors and then communicate with them to ask them to pay, usually in writing or over the phone.

Alternatively, some debt collection agencies might offer to purchase the debt from the company that is owed the money. However, they will buy the debt well below its value and hope to recover as much of the debt as possible to make a profit.

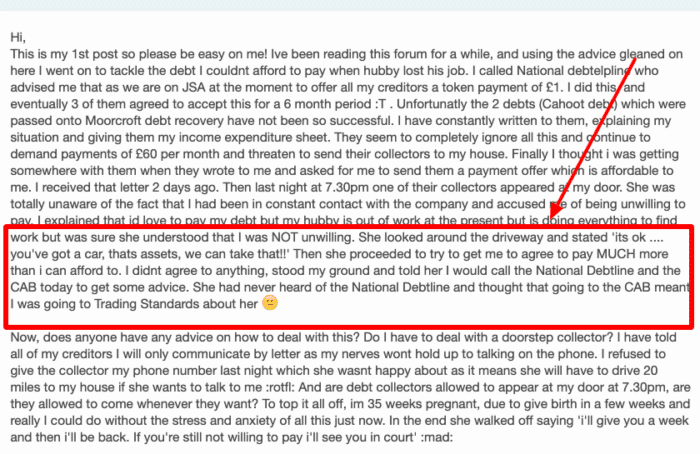

Debt collection businesses might use different techniques to get debtors to pay, but most collection agencies follow a typical debt recovery process. They must adhere to fair debt collection practices, although in my experience, many will try to push their luck. The forum entry below shows how one debt collector insinuated she had more power than she actually did:

Debt collection agency vs enforcement officers (bailiffs!)

The term “debt collectors” can sometimes be misused to refer to enforcement agents, better known as bailiffs. However, it’s important to know that a debt collection agency is not a bailiff company.

As will be explained further down this guide, debt collection agencies don’t have the same rights and legal powers as bailiffs have.

How much do debt collectors charge?

Debt collectors are commercial businesses that must charge to help collect debt on behalf of the business. Some debt collectors charge a fixed fee for their work, whereas others offer their services for free but will take a commission on any debt repayments the debtor makes.

Both price structures have pros and cons.

Are debt collection agencies legal?

Debt collection agencies are legitimate businesses legally allowed to offer services to help creditors track debtors and request payment. However, debt collection agencies must follow strict rules when attempting to recover the debt. They cannot threaten or harass debtors to make them pay.

How do I know the debt collection agency is real?

If you’re contacted by a debt collection agency about a supposed debt you owe, it’s important to verify that the debt collection agency is legitimate first.

There have been several instances of scam debt collection agencies contacting people for payment in a threatening manner. Some people panic when they receive these communications from scam debt collectors and end up paying out of stress and fear.

To verify the debt collection agency is real and legitimate, you can make sure:

- Check the business has an online presence.

- Check that they are authorised and regulated by the Financial Conduct Authority (FCA)

- Check that the business contact information corresponds with the contact information on that debt collection agency’s website. Some scams may pretend to be real businesses!

- Ask the debt collection agency to provide you with details. If they’re real, they should already know your name and details of the alleged debt.

If they are not legit, or you have your suspicions, contact the police.

What happens when a debt is sold to a collection agency?

When a debt is sold to a debt collection agency, the money you owe is now owed to the debt collection agency instead of the original creditor.

If you’ve had a bad experience dealing with the original company you owe, you may even wish that your debt would be bought. Or you might even ask: Can you sell your personal debt to someone else?

How much do debt collectors buy debt for?

If a debt collection company buys the debt from the company, it will usually pay around 10-20% of the total value of the debt.

This is because the debt collection company is taking on a risk that they might not manage to recover any of the debt and thus guarantees a big profit if they do.

For example, if you owe £1,000 on personal loan arrears, the debt collector company might offer between £100 and £200 to buy this debt from the loan provider. You’ll then owe the £1,000 to the debt collector, and if you pay it all, the debt collector makes a big profit.

But the debt collector loses money if you refuse to pay, and no further action is taken.

Will a collection agency add more interest and charges?

Debt collection agencies might add further charges and interest to your debt if they have purchased and owned it. They can only add charges and interest within reason and to the extent of any additional costs incurred.

If they haven’t purchased the debt and it’s still owed to the original company, the company will add interest and charges. The debt collection business will inform you of their decision to add charges, but again, any charges and interest must be within reason and reflect real expenses.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What to do if your debt has been passed to a debt collection agency

If you’ve been informed that a debt has been passed to a debt collection agency or purchased by a debt collection business, you should expect them to make contact soon. The first communication usually comes as a letter asking you to pay.

It’s wise to start thinking about how you will deal with the debt rather than only thinking about how you will deal with the debt collection agency.

You can do this by speaking with a debt charity for free to learn about your options, including various debt solutions. Some solutions may freeze interest and charges or write off some debt. Learn more about debt charities and debt repayment strategies via my debt info page.

Impact of debt collection on your credit rating

Having a debt sent to collections can significantly impact a person’s credit rating in the UK. When a debt is sent to collections, it means that the original creditor has given up on trying to collect the debt directly from the borrower and has enlisted the services of a third-party debt collection agency. Here’s how this can affect a person’s credit rating and the steps to mitigate its impact:

When a debt is sent to collections, it will likely be reported to credit reference agencies in the UK, such as Experian, Equifax, and TransUnion. These agencies compile credit reports that contain information about an individual’s borrowing and repayment history. The presence of a collection account on a credit report is viewed negatively by lenders and can lead to the following consequences:

- Lower Credit Score: A collection account can cause a significant drop in a person’s credit score. This makes obtaining new credit or loans harder and can lead to higher interest rates if they are approved for credit.

- Difficulty Obtaining Credit: A collection account on your credit report signals to potential lenders that you may have a higher credit risk, making it more challenging to be approved for new credit lines or loans.

- Limited Access to Good Rates: Even if you manage to get approved for credit, you might only qualify for higher interest rates and less favourable credit terms due to the perceived increased risk.

How do debt collectors find you?

Debt collectors can find you by using the contact information supplied to the company that you owe.

For example, if you have electric bill arrears, the debt collector will try contacting you at your home address connected to the energy account. If this isn’t possible, the debt collection agency might use public records to try and find you.

Sometimes, debt collection agencies struggle to find the debtor, especially if they have no known address or if you have recently moved. In this event, the debt collection agency might use a scatter-gun approach to find you. They send the same debt collection letter to multiple addresses where there is a possibility you reside in the hope that you’ll reply and identify yourself.

The consequence of using a scatter-gun approach is that many innocent people receive a debt collection letter about a debt that isn’t theirs.

What can a debt collector do?

Debt collectors have a right to contact you and ask you to pay. They also have the right to tell you what they or their client plans on doing if you don’t pay, which usually involves legal threats.

If that’s their genuine plan, a debt collector can only tell you they plan to take you to court. They shouldn’t make legal threats if they don’t plan on taking this action.

Debt collection businesses can’t do a lot more than that. In fact, what a debt collection business can do isn’t anything more than what the original creditor can do. They have the same powers. Yet, companies still outsource the debt collection process to debt collectors for convenience and efficiency.

How to stop debt collectors from calling (UK)

One of the biggest complaints among debtors dealing with debt collectors is that they call too frequently or call at unreasonable times. You can stop this from happening by writing to the debt collection agency and asking them to call less frequently or at a certain time of the day. Keep a copy of this letter.

Unfortunately, a debt collector can legally contact you to ask you to pay a legitimate debt you owe. So you won’t also be able to stop the debt collector from sending letters.

If the debt collection agency doesn’t acknowledge or respect your communication preferences, you can make an official complaint about its behaviour. You must keep a copy of the initial letter as evidence.

Will debt collectors visit my house?

There are reports of some debt collection agencies sending their field workers to debtors’ homes to ask them to pay. But overall, this is quite rare.

Most debt collector contacts asking you to pay the money owed will be made over the phone or in writing.

Can debt collectors come to your house without notice?

A debt collector can come to your home to ask you to pay a debt you owe. No formal process, including giving notice, must be followed, like when a bailiff comes to your home.

However, once a debt collector does come to your home, they have no powers, and you can ask them to leave.

Can debt collectors enter your home?

A debt collector cannot enter your home; you can simply refuse to speak with them and request they leave.

If they don’t leave or suggest they can come into your property and remove goods, you can call the police and complain about the debt collection company to the FCA.

Some people think debt collectors can come to your home to take goods. Some even worry that debt collectors will take things they really need, like their car, but this misunderstanding is usually because they confuse debt collection businesses with bailiffs.

A bailiff can attempt peaceful entry into your home to seize possession of assets when they have a court warrant. But a debt collection field agent never has this power.

Can debt collectors come to my work?

No, a debt collection agency shouldn’t contact you at work because they’re not allowed to disclose that you have debts to any third party, including your employer.

If a debt collection worker tries to speak with you at work, you should complain to the Financial Ombudsman.

What can I do if debt collectors are harassing me?

Debt collection harassment is serious and illegal. Nobody is allowed to be harassed, even when they owe money. Harassment includes being contacted too frequently or at certain times of the day.

If a debt collector or a creditor is harassing you, you should gather evidence of the harassment. For example, if you’re being called or texted multiple times per day, you could get copies of call logs from your mobile provider.

You should then submit a complaint to the entity responsible for the harassment and a copy of your evidence. If the harassment doesn’t stop, you can escalate the complaint to the FCA.

What can debt collectors not do?

Debt collectors cannot:

- Harass you to pay

- Threaten you in any way

- Enter your home without permission

- Suggest they have powers that they don’t have (such as being able to take your goods)

- Disclose the debt to any third party, including family, friends or an employer

Can I just ignore the debt collectors?

You shouldn’t ignore letters from a debt collection agency, even if you know they have the wrong person.

If you ignore their letters and owe the debt, you could be subject to legal action and a court order. And if you don’t owe the money, you can expect further communications, which can be stressful.

Thankfully, there are ways to deal with UK debt collectors when you know about the debt or believe there has been a mistake.

Can debt collection agencies take you to court?

A company that believes a debtor owes it money can take the debtor to court and ask for a judge to issue a court order to make them pay. Failing to pay a court order can result in further action, including the possibility of using bailiffs.

The debt collection agency will likely make legal threats like these through a special letter called a Letter Before Action (LBA). The creditor must send an LBA before they can take legal action. But a clear distinction must be made.

The debt collection agency might make legal threats, but they won’t be the ones taking you to court unless they have purchased your debt. The company is owed the money that takes you to court. Third-party debt collectors may simply make legal threats on their behalf.

They cannot take you to court if the debt is statute-barred, thanks to the Statute of Limitations on debt collection.

How to deal with debt collectors in the UK

The best way to deal with debt collectors is to respond to their initial letter. Delaying a response may only worsen things and could add (reasonable!) charges and interest to the debt.

You should respond by requesting proof that you owe the debt. A debt collection agency cannot simply say you owe the money and demand payment. They have to provide proof you owe the debt. But many collection groups assume you don’t know this and just ask for payment instead.

MoneyNerd has made it quick and simple to ask for proof you owe the debt. We have made a free-to-download prove-the-debt letter template. You only need to download this free template, add your details, and send it off. It’s best to keep a copy as evidence you requested proof, in case the debt collector doesn’t respond and the matter goes to court later.

A collection agency is contacting me about a debt that isn’t mine

If you’re receiving debt collection letters at your address for someone else, it’s best to call the debt collection group and let them know they have the wrong address.

Many debt collectors will be reasonable and stop sending letters, but some might want evidence that you really aren’t the debtor.

You’re not obligated to prove your identity, and you could send a prove the debt letter instead. If they respond without proof that you owe a debt in your name, you have evidence that they have made a mistake and can use it if the matter was escalated to court.

What proof must a debt collector provide?

UK debt collection laws state that the agency must respond to your proof of the debt letter. They have to send a copy of the agreement or contract you failed to pay, which resulted in the debt.

For example, if you have personal loan arrears, they should send a copy of your personal loan credit agreement, signed by you.

They cannot keep asking you to pay if they fail to send you the required proof. This is why a prove-it letter is one of the most effective ways to beat UK debt collectors and one of the few ways to avoid paying.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should I pay a debt collection agency?

You only have to pay a debt collection agency once it proves you owe the money. If the debt collection group provides evidence that you owe the debt, it’s wise to pay or look for other ways to get out of the debt.

What to do if you can afford to pay the debt

If you can afford the debt, you may want to pay it in full to avoid further fees or charges. Alternatively, you might want to consider a debt settlement offer to try and save money. But this will negatively impact your credit score.

How much will debt collectors settle for (UK)?

You might consider making an offer to settle the debt with the debt collection agency for less than its actual value. For example, if you owe £1,000, you might offer £800 to settle the debt.

There is no fixed percentage that the company will settle for. If the debt collector purchased the debt for much less than its real value, you may have more chance of acceptance.

Can debt collectors see your bank account balance?

A debt collection company cannot see how much money you have in your bank account and, therefore, cannot influence its decision on your debt settlement offer. More information on what they can and cannot do can be found here.

What to do if you can’t afford to pay the debt

Let the debt collection agency know if you cannot afford to pay the debt. Explain how much you can realistically afford to pay as part of a repayment plan. If accepted, this will prevent the matter from escalating to court and potentially the use of bailiffs.

Can debt collectors ask for proof of income?

If you make a repayment plan offer, the debt collector might ask you to prove you can keep up with these repayments by proving your financial situation. This could increase our chances of having the proposal approved. But you’re not obligated to disclose your finances to them.

If a creditor or other entity wants to find out about your income, they must apply to the court to get this information.

- PO Box 107, Caerphilly CF83 3GG — Who Is It?

- DWP’s costly mistakes

- Your Rights with Debt Collectors: A Simple Breakdown

- 01782401191 – Who Called? Stop Advantis Credit

- Debt Validation Letter for the UK – Free Template

- CDER Group Debt – Should You Pay?

- Enforcement of UK Judgments Abroad – What You Need to Know

- PO Box 123 Burton on Trent DE14 2XE – Who’s Contacting Me?

- Can Debt Collectors Come to Your House in Scotland?

- Credit Limits International Debt Collection – Should I Pay?

- Aqua Debt Collection – Do You Really Have to Pay?

- H Collect Debt – Must You Pay?

- Student Loan Debt Collectors – Do I Have to Pay?

- Searchlight Collections Debt – Should I Pay?

- DWF Solicitors Debt Recovery – Do I Have to Pay?

- When Do Debt Collectors Give Up? (According to UK Laws)

- Debit Finance Collections Plc (DFC) – Should You Pay?

- Coltman Warner Cranston Debt – Should You Pay Them?

- Debit Finance – Should You Pay?

- Scott Mears Debt – Should You Pay Them?

- Lowell Telecom on Credit Report – Who Are They?

- Gladstones Solicitors Debt – Should You Pay?

- LC Asset 2 SARL on Bank Account – What Now?

- PO Box 8743 Bellshill Debt Letter – Who is it?

- PO BOX 795 Telford TF7 9GG Letter – Who is it?

- LCMS Limited – Should You Pay?

- Are You Owed Money – Should You Pay?

- Hellix Ltd – Should You Pay Them?

- Overdales – Everything You Need to Know

- Village Investigations Ltd – Do You Have to Pay?

- EDF Debt Collectors – Should you Pay?

- Ascent Performance Group Debt – Should You Pay?

- Credit G Debt – Should You Pay Them?

- ACT Credit Management Debt – Should You Pay?

- Churchill Recovery Debt – Should You Pay?

- Conexus Recovery Debt – Should You Pay?

- Kearns Solicitors Debt – Should You Pay?

- UK Search VT – What You Need To Know

- Sonex Financial Debt – Should You Pay?

- TNC Collections – Should You Pay?

- We Want to Say Yes – Should You Pay?

- Link Financial Harassment? Here’s What to Do

- UK Search Limited – Should You Pay?

- Henriksen Limited – Should You Pay?

- Themis Recoveries Debt – Should You Pay?

- Wilson & Roe High Court Enforcement – Should you Pay?

- ‘firstclear ltd ‘ on Bank Statement – Who Are They?

- PO Box 17 Stockport SK1 4AJ Debt Letter – Who is it?

- ‘eui ltd prem tr’ Bank Statement – Who Are They?

- Zenith Collections – Beat Debt Collectors (Guide, FAQs & More)

- ZZPS Debt Collection for Parking Fines – Should You Pay?

- Vodafone Debt Collection – Should You Pay?

- UKSL Debt (UK Search Limited) Should You Pay?

- IMFS Debt Collection – Should You Pay?

- ICB Debt (Insurance Collections Bureau) – Should You Pay?

- HSBC Debt Collection Agency – Do You Need to Pay?

- HMRC Debt Collection Process Explained – Do You Have to Pay?

- EE Debt Collection – Do You Have to Pay?

- DVLA Debt Collection Agencies Guide – Past Due, Capital Resolve, etc

- Cobra Financial Debt Collection – Do You Need to Pay?

- Can debt collectors find my new address? Quick Answer

- CLI International Debt Collectors – Should You Pay?

- British Gas Debt Collection Agency – Should You Pay?

- Bluestone Debt Credit Management, HMRC – Should You Pay?

- ACI Debt (Asset Collections & Investigations) Should You Pay?

- ‘Newlands House, Caxton Way, Eastfield Scarborough’ Debt Info

- Controlaccount (Control Account Plc) Debt Recovery – Pay FedEx, DHL, etc?

- Orbit Debt Collection Ltd – Should You Pay?

- How to Complain about Debt Collection Agencies?

- DWP Debt Management Letter – Should You Pay?

- One Call Debt Recovery – Should You Really Have To Pay?

- How to Beat Debt Collectors UK? Quick guide

- Can Debt Collectors See Your Bank Account Balance? UK Guide

- Handling Debt Collector Harassment: Know Your Rights

- Zinc Group Credit Management Debt – Should You Pay?

- CARS Debt (Creditlink Account Recovery Solutions) Should You Pay?

- Property Debt Collection (PDC) Do You Need to Pay?

- Hoist Finance Debt Collection – Should You Pay? UK Laws

- Can Debt Collectors Call or Come to Your Work?

- Credit Security Limited Debt – Must You Pay?

- PayPal Debt Collection – Negative Balance Consequences

- Flint Bishop Debt Recovery – Must You Pay?

- DWP Debt Management Frequently Asked Questions

- Richburns Debt Recovery – Should You Pay?

- Trace Debt Recovery – Should You Pay?

- How to Complain about Debt Collection Agencies? Complaints

- Shop Direct Finance Group Debt – Should You Pay?

- Redwood Collections Debt Recovery – Should You Pay?

- JTR Collections Debt – Must You Pay?

- CCI Credit Management Debt – Should You Pay?

- Creditlink Account Recovery Solutions Debt (CARS) Guide

- How Do Debt Collectors Find You in the UK?

- Debt Collection Agency – All You Need to Know with FAQs

- How to Stop Debt Collection Letters – Complete Guide

- How Much Do Debt Collectors Buy Debt for in the UK?

- What Can Debt Collectors Do UK?

- Can Debt Collection Agencies Take You to Court?

- MIL Collections Debt Collectors – Should You Pay?

- Lloyds TSB Debt Recovery – Do You Need to Pay Them?

- LCS Debt Recovery (LCSDR) – Should You Pay?

- DRS Collection (Debt & Revenue Services) Should You Pay?

- Lantern Debt Recovery UK – Should You Pay?

- Transcom Student Loan & eBay Debt – Should You Pay?

- Mortimer Clarke Solicitors Debt – Should You Pay?

- Asset Link Capital Debt Collection – Should You Pay?

- Santander Cards Debt Collections & Recovery – Must You Pay?

- Ardent Credit Services Debt Recovery – Should You Pay?

- How Not to Pay Debt Collectors When You Can’t Afford to Pay

- What Rights Do Debt Collectors Have?

- How Long can Debt Collectors Try to Collect UK?

- PO Box 140 Normanton WF6 1YA Debt Letter – Who is it?

- Link Financial Debt – Should You Pay?

- Allied International Credit Debt (AIC) Should You Pay?

- CRS Debt Collectors (Credit Resource Solutions) Should You Pay?

- Capita Returns Management Debt Collection – Should You Pay?

- HFC Bank Ltd – What Happened to Them?

- Moriarty Law Debt Collection – Should You Pay?

- Phillips & Cohen Associates Debt – Should You Pay?

- Stirling Park Debt Collection – Should You Pay?

- Daniels Silverman Debt Collectors – Should You Pay?

- Scott and Co Debt Collectors – Should You Pay?

- STA International Debt Collection – Should You Pay?

- Opos Limited Debt Collection – Should You Pay?

- Walker Love Debt Collectors – Do You Have to Pay?

- JC International Acquisition LLC Debt Collection Guide

- Icon Collections Debt – Do You Have to Pay?

- BCW Group PLC Debt Collectors – Must You Pay?

- Credit Style Debt (CST Law) Should You Pay?

- Download The “Prove It” Letter Templates

- Advantis Credit Debt Collection – Should You Pay?

- Arc Europe Ltd Debt Collection – Should You Pay?

- BPO Collections Debt – Should You Pay?

- CapQuest Debt Recovery – Should You Pay?

- Credit Solutions Ltd Debt Collectors (CSL) – Should You Pay?

- Drydensfairfax Solicitors Debt – Should You Pay?

- Intrum Debt Collection – Should You Pay? UK Guide

- Wescot Credit Services Debt Collectors – Should You Pay?

- Arrow Global Debt – Should You Really Have To Pay?

- Shoosmiths Debt Recovery & Collection – Do You Have to Pay?

- Student Loan Overpayment Debt Collection – Do I Have to Pay?

- 01482483281 – Who Called? Stop Wescot Debt Collectors

- 01513056749 – Who Called? Stop Debt and Revenue Services

- 01782401192 – Who Called? Stop Advantis Debt Collectors

- 01142317440 – Who Called? Stop Bluestone Debt Collectors

- PDCS Pastdue Credit Solutions Debt – Should You Pay?

- 01513293649 – Who Called? Stop Global Recovery Services

- BW Legal Debt Collectors – Should You Pay?

- Resolvecall Debt Collectors (Resolve Call) – Should You Pay?

- Lowell Financial Debt Collection – Should You Pay?

- Cabot Financial Debt Collectors – Should You Pay?

- Moorcroft Debt Recovery – Should You Pay?

- EOS Solutions Debt Collection – Must You Pay?

- 08081965550 – Who Called? Stop PRA Debt Collectors

- NCO Europe Debt Collection – Should You Pay?

- 01389493417 – Who Called? Stop Opos Debt Collectors

- Central Debt Recovery Unit Group Debt – Do You Need to Pay?

- Mackenzie Hall Debt Collectors – Do You Have to Pay?

- CL Finance Limited Debt – Do You Have to Pay?

- Here’s Whether You Should Pay Judge & Priestley Debt

- Harlands Group Debt – Should You Pay?

- Elderbridge re: HCA Debt – Should You Pay?

- CCS Collect Debt (CCSCollect) Should You Pay?

- Shakespeare Martineau Debt Recovery – Must You Pay?

- QDR Solicitors Debt Recovery – Should You Pay?

- PRA Group UK Limited Debt – Should You Pay?

- Jacobs Enforcement Agents Debt – Should You Pay?

- HO Collections Account Debt – Do You Need to Pay?

- PO Box 189 Huddersfield HD8 1DY – Who’s Contacting Me?

- NewDay Debt Collection – Do You Have to Pay?

- 02033733588 – Who Called? Stop One Source Debt Resolution

- 1st Locate UK Debt Collection – Should You Pay?

Can a debt collector refuse a payment plan?

A debt collection agency doesn’t have to accept an offer of a payment plan. But if you provide that you’re doing your best to repay while maintaining an essential standard of living, the debt collector is less likely to refuse the plan.

But remember, unless the debt collection group bought your debt, the payment plan refusal would come from the company you owe – not the debt collection agency.

If a debt collector does refuse your repayment plan proposal, you might want to explore different debt solutions, such as a Debt Management Plan or Debt Relief Order.

How long will a debt collector chase me?

Debt collectors will continue to chase you to pay for as long as they’re legally allowed. Some debts become too old to be collected after so many years, depending on the type of debt and your location.

Most debts become too old to be recovered after five years in Scotland and six years in England and Wales. The time limit resets if you pay or acknowledge ownership of the debt in writing. And the time limit becomes unlimited if a court order asks you to pay.

How long can HMRC chase a debt?

There is no time limit on how long you can be chased to pay an HMRC debt. Unlike other debts, these tax debts don’t become too old to collect.

Can debt collectors send me to jail?

No – debt collection agencies cannot send you to jail. It’s not possible to be sent to prison for most debts.

How can I find out what debt collectors I owe?

The best way to identify what debts you owe is to check your credit file. Your credit report should state what debts you have owed within the previous six years, including current debts.

I’m vulnerable – should I let the collection agency know?

If you’re vulnerable, it’s worth telling the debt collection agency. They should understand your vulnerability; the best companies will offer personalised solutions.

What should I do if a debt collector violates FCA guidelines?

You should make a complaint if a debt collection agency violates the guidelines set down by the Financial Conduct Authority (FCA).

How do I complain about a debt collection agency?

Complaining about debt collection agencies involves three main stages. These are:

- Gather evidence of the nature of the complaint

- Complain to the debt collection agency and the company that hired it

- If no resolution is made, escalate the complaint to the Financial Ombudsman

The Ombudsman can fine a debt collection agency and even request the company to write off your debt if you’ve been wrongfully treated.

How does international debt collection work?

Some people have debts in other countries or have a UK debt but then move abroad. The debt can still be chased and recovered even if you don’t live in the country anymore. But getting its money back can be more difficult for the company.

Sometimes the company will employ an international debt collection agency with sister companies in various locations. The sister company could then chase you for payment in your new location.

Where to get help

I know that it can be stressful dealing with debt collectors, especially if you are unsure of your rights. As well as all of my helpful guides and information, you can also get free, impartial advice from the following UK debt advice services:

| Organisation | Website | Phone number |

| Stepchange | http://www.stepchange.org | 0800 138 1111 |

| National Debtline | http://www.nationaldebtline.org | 0808 808 4000 |

| PayPlan | https://www.payplan.com/ | 0800 316 1833 |

| Citizens Advice | http://www.citizensadvice.org.uk | England: 0800 144 8844 Wales: 0800 702 2020 |